Earned leave is one of the most valuable leave benefits for employees in India. It gives you paid days off that you collect throughout the year and use for travel, vacation, personal needs, or simple rest to maintain work-life balance. Yet the actual rules around earned leave often feel unclear because every organisation follows its own policy. Government employees follow defined structures, while private employees depend on internal HR rules that may differ widely. This guide explains the earned leave policy for 2026 in a clear and practical way so you understand your entitlement and plan your leaves properly.

What is earned leave?

Earned leave (EL) is a paid break employees receive as a reward for continuous service. These leave days build slowly and can be used for various reasons. The number of days you earn depends on company or government rules, usually 1.5 to 2.5 days each month.

It is different from casual or sick leave because you earn it over time and can often carry it forward or encash it based on company rules.

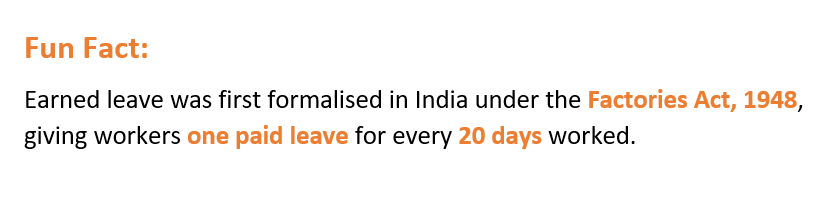

The idea comes from early labour laws, where workers needed guaranteed rest after long work cycles. Today, EL supports planned time away from work without losing salary.

Also Read - How to Write a Leave Letter for Fever: Format & Samples

What are the other names for earned leave?

Different organisations use their own terms for earned leave, but all of them refer to the same type of paid and planned leave.

- Privilege leave (PL)

- Annual leave

- Vacation leave

- Long leave

- Paid leave (in some companies)

Also Read - Privilege Leave: Meaning, Calculation, Encashment Rules in India

What are the common reasons to take earned leave?

Employees use earned leave when they need uninterrupted time away from work for planned activities and personal needs. Here are the common reasons for using earned leave:

- Travel or holidays with family

- Long breaks to reset

- Attending weddings or festivals

- Handling personal life paperwork or home-related work

- Health recovery after illness or fatigue

- Mental health breaks to reduce stress

- Child care or parent care responsibilities

- Moving to a new house

- Preparing for exams or attending classes

- Religious functions or rituals

- Short getaways to avoid burnout

- Extended weekends for rest and relaxation

Also Read - Leave Extension Letter: Sample Applications & Emails

Understanding the earned leave policy in India

The earned leave policy in India sets the basic framework for how employees earn paid leave through the days they work.

The policy explains key points like:

- How leave is credited

- How it can be used

- How companies should record these days

- What happens to unused leave at the end of the year or during exit

Also Read - Leave Application for Festival in Office with Format & Samples (2026)

Key laws that influence earned leave in India:

- Factories Act, 1948 – Governs earned leave for workers in factories.

- Shops and Establishments Acts (State-wise) – Each state sets its own rules for shops, offices, and private businesses.

- Central Civil Services (Leave) Rules, 1972 – Applies to central government employees.

- State Civil Service Leave Rules – Guide earned leave for employees in state government departments.

- Occupational Safety, Health and Working Conditions (OSH) Code, 2020 – Part of the new Labour Codes bringing updated leave standards (including the reduced 180-day requirement).

These laws act as the foundation. Companies then build their policies on top of them, creating the final rules employees follow.

- Earned leave policy for public-sector companies

Public-sector companies follow government-issued leave rules such as the Central Civil Services (Leave) Rules, 1972 or their respective State Leave Rules. These policies are usually standard across departments, which makes them predictable for employees and easier to plan around.

- Earned leave policy for private companies

Earned leave for a private company is mainly guided by the Shops and Establishments Act of the state in which the business operates. Along with this, each organisation creates its own HR policy. Since private companies only need to meet the minimum legal standards, many details can differ from one employer to another. This is why employees should always read their company’s leave policy to understand how earned leave is managed in their workplace.

Earned leave eligibility and entitlement

Earned leave eligibility in India depends on two main factors:

- How long has an employee worked?

- And the type of organisation they belong to

Most employees become eligible for earned leave after completing a set number of working days in a year. Under the upcoming Labour Codes, this requirement is expected to shift from 240 working days to 180 working days, which will help new employees access EL benefits sooner.

Below is a simple breakdown of how eligibility and entitlement work across different sectors:

- Government and public-sector employees

Government employees follow well-defined leave rules set by central or state authorities.

- Government employees who hold permanent positions earn their leave at a rate of about 2.5 days each month. This gives them nearly 30 days of earned leave in a year.

- Leave is usually added at the start of the year.

- Unused leave can be stored for many years, often up to 300 days, which becomes useful at retirement.

- Private-sector employees

Private companies set their own earned leave rules, as long as they meet minimum legal standards under the Shops and Establishments Act.

- Many private companies offer 12 to 30 days of earned leave depending on their work culture and industry.

- Some add leave monthly, while others credit it yearly.

- Start-ups and IT companies may offer more flexible rules, while traditional sectors may stick to fixed structures.

- Contractual and fixed-term employees

People working on contract earn leave only if it is clearly mentioned in their agreement.

- Some receive 1 day of earned leave for every month completed.

- Some get a small block of leave for the entire contract period.

- Short-term or project-based contracts may not include earned leave at all.

- Any unused leave at the end of the contract may be encashed or may lapse, depending on the terms.

Also Read - One Day Leave Application for Office: Format & Samples

Typical earned leave entitlement in India

| Employee Type | Annual Earned Leave | Carry-Forward Limit |

| Central Govt Employees | Around 30 days | Up to 300 days |

| State Govt Employees | 15 to 30 days | As per state rules |

| Private-Sector Employees | 12 to 30 days | Usually 45 to 60 days |

| Contract Employees | Varies by contract | As per policy |

Earned leave rules in India

Earned leave rules in India help employees understand how their leave can be used and what happens to unused days. Below are the common guidelines most employees follow when planning earned leave.

- Leave must be earned through active service

Employees collect earned leave gradually as they work. Most organisations credit leave monthly or at specific intervals during the year.

- Prior approval is required

Earned leave is meant for planned breaks. Employees usually need to apply at least one to two weeks in advance so managers can manage workload and arrange coverage.

- Carry-forward limits apply

Companies allow employees to carry unused leave into the next year, but only up to a fixed limit. Anything beyond this limit may lapse or be encashed, depending on policy.

- Encashment depends on organisation rules

Some employers allow encashment only at the time of full-and-final settlement, while others offer year-end encashment. The calculation is usually based on basic salary.

- Prefix and suffix rules may apply

Many companies set rules for combining earned leave with weekends, holidays, or other types of leave. Employees must follow internal policies to avoid rejection.

- Rules differ across sectors

Government departments follow structured guidelines, while private companies set their own HR policies. Even within government roles, earned leave rules for state government employees vary because each state issues its own leave policies.

Also Read - Leave Encashment Rules: Tax Exemptions Limit, Calculation Formula & More

Earned leave calculation (with example)

Earned leave is calculated based on how many days an employee has actually worked during the year. Most companies follow a standard approach, which helps employees track how their leave balance grows.

Earned leave calculation formula

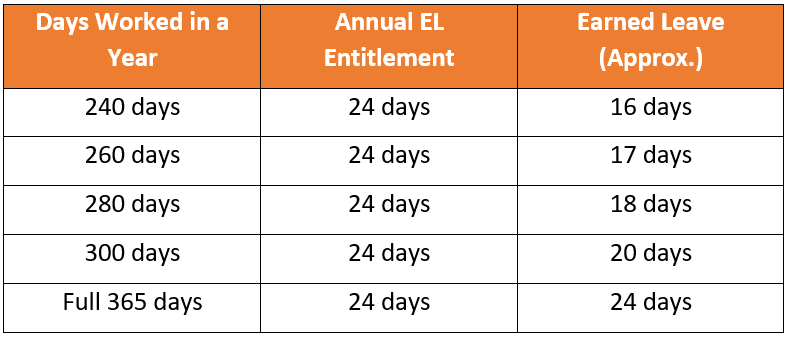

The most common earned leave calculation formula looks like this:

(Number of days worked × Annual EL entitlement) ÷ 365

This gives a fair and transparent way to calculate leave for both full-year and partial-year employees. Some companies also offer a simple earned leave calculation table to help staff see how many leaves they earn each month.

Example:

If an employee is entitled to 24 earned leave days per year and has worked 280 days:

(280 × 24) ÷ 365 = 18.4, which is rounded to 18 days of earned leave.

Employees who want a quick estimate often use an internal earned leave calculator provided in the HR portal, which shows their leave balance in real time.

Sample earned leave calculation table:

Encashment of earned leave

Encashment of earned leave allows employees to receive payment for the leave days they did not use. This becomes useful during year-end settlements, retirement, or when closing employment with an organisation. The amount paid depends on the employee’s basic salary, and in many government roles, dearness allowance is also added to the calculation.

Each sector follows its own rules:

Government sector

- Central government staff can encash earned leave at retirement for up to 300 days.

- The limit is 120 days for state government employees.

- Encashment is fully tax-free for government employees under Section 10(10AA).

Private sector

- Encashment depends entirely on company policy.

- Some offer full encashment, others only allow it during final settlement.

- Unused leave cannot be claimed after the employment period ends unless eligible for encashment.

- For private employees, the amount received is taxable as salary, except for the ₹3,00,000 lifetime exemption allowed under income tax rules.

Encashment is calculated using the employee’s basic pay and the number of earned leave days approved for payment.

Example:

Suppose your basic salary + DA = ₹32,000 per month, and you have 20 earned leave days available for encashment.

Using the formula:

Leave Encashment = (Basic Salary + DA) ÷ 30 × No. of ELs

Calculation:

₹32,000 ÷ 30 = ₹1,066.67 (per day pay)

₹1,066.67 × 20 = ₹21,333

So, your total earned leave encashment will be ₹21,333.

Earned leave carry forward

Carry forward allows employees to take unused earned leave into the next year. This helps people save leave for long trips or important personal situations.

Government sector

- Central government employees can accumulate earned leave up to 300 days.

- Most state government departments have limits between 180 to 300 days, depending on their service rules.

Private sector

- Many companies allow employees to carry forward 30 to 60 days of earned leave.

- Some industries offer a higher cap (120 days), especially when long-term leave planning is common.

- Any leave above the carry-forward limit may expire or get automatically encashed if the policy allows.

Earned leave surrender

Surrendering earned leave means choosing to give up a portion of your leave balance in return for monetary compensation while still working. It is different from encashment during exit because surrender happens during active employment.

- Many government departments let employees surrender a fixed number of days during service, often when claiming LTC (Leave Travel Concession).

- The surrendered leave is paid out based on basic salary, just like encashment at retirement.

- Surrender options are less common in private companies. They only offer encashment at the time of exit.

- Some organisations include surrender during annual performance cycles, but this varies widely.

Also Read - LTA (Leave Travel Allowance) in Salary – Calculation, Exemption & More (2026)

Earned leave during notice period and on resignation

Earned leave during the notice period follows stricter rules because the employee is already in the exit process. Most companies avoid approving planned leave once a resignation has been submitted.

- Taking leave during notice period

- Employees usually cannot take earned leave without clear approval from the employer.

- If leave is taken, many organisations extend the notice period by the number of days taken off.

- Government departments may allow leave only in urgent situations and with proper justification.

- Encashment on resignation

- Almost all employees receive encashment for unused earned leave at the time of full-and-final settlement.

- The payout is based on basic pay (and DA for government roles).

- Private-sector companies may apply limits or exclude certain leave types from encashment.

Also Read - All About Serving Notice Period – Indian Laws, Negotiation & Leave Policy

New earned leave rules in 2026 (under labour codes)

The new Labour Codes are expected to bring a more standard approach to earned leave across India. Here are the key proposed changes:

- Eligibility reduced from 240 working days to 180 days.

- Monthly leave accrual continues after eligibility.

- Unused leave beyond 30 days to be carried forward or encashed, preventing lapsing.

- Clearer digital leave records required for compliance.

Note: The Labour Codes are approved but not fully implemented yet. Final rules may change, and we will share updates once notified.

Also Read - How to Write Leave Application for Urgent Work: Format & Samples (2026)

How to apply for earned leave (Step-by-Step guide)

Applying for earned leave is simple, but following the right steps helps avoid delays or rejection. Here’s a simple guide to make the process smooth.

- Check your leave balance on the HR portal or payslip.

- Decide your leave dates and make sure they don’t clash with key work commitments.

- Submit a leave request through your HR system or email your reporting manager.

- Government departments may require leave application in a prescribed format.

- Share a short reason if your company requires it.

- Apply at least 7 to 15 days in advance for planned leave; longer vacations may need earlier notice.

- Wait for approval and keep a copy of the confirmation for your records.

Note: For longer leave (5+ days), some companies may ask for travel tickets, medical certificates, or any other supporting documents if combining EL with other leave types.

Important: Earned leave is approved by the reporting manager and HR in private companies, while government employees need approval from their controlling officer or department head.

Also Read - Leave Application for Vacation in Office: Request Letter Examples

Sample earned leave application

Also Read - Earned Leave Application: Letter Format & Calculation

How to check your earned leave balance

It is easy to check your earned leave balance, and most companies offer more than one way to view it.

- Log in to your company’s HR or leave management portal.

- Check your monthly payslip for updated leave balances.

- Ask your HR team for your latest leave report.

- In government jobs, check the service book or department leave register.

Also Read - Two Days Leave Application for Office: Format & Samples (2026)

Quick comparison: Casual leave vs Earned leave

Casual leave and earned leave serve different purposes at work. This quick comparison helps you understand when each type is most suitable.

| Feature | Casual Leave (CL) | Earned Leave (EL) |

| Main purpose | Short breaks for quick needs like appointments or urgent personal work. | Longer planned breaks for travel, rest, or family responsibilities. |

| How it is given | Given as a fixed yearly quota (usually 8 to 12 days). | Built slowly through the year based on days worked. |

| Typical duration | Often taken for 1 to 2 days at a time. | Can be taken for several days at once. |

| Carry forward | Mostly not allowed. | Allowed up to company limits. |

| Encashment | Rarely allowed in most companies. | Can be encashed during full-and-final settlement or retirement. |

| Combining with other leave types | Sometimes allowed with sick leave but limited. | Can be combined with other leave types depending on policy. |

Also Read - Casual Leave Policy in India: Rules, Entitlements & Calculation

Wrapping up

Earned leave is a yearly benefit that helps you plan personal time and maintain a healthy work-life balance. Understanding the rules, eligibility, and calculations makes it easier to manage your leave without losing any entitled days.

If you are looking for a company that offers a better earned leave policy and stronger employee benefits, find top tech opportunities on Hirist, India’s leading IT job portal.

Also Read - Sick Leave Email in Office: Templates, Samples & Examples

FAQs

TCS employees earn 16 to 20 earned leave (EL) days a year, credited as 4 days per quarter. These leaves can accumulate up to a maximum of 48 days. Any balance beyond this limit is usually encashed automatically around March or paid during final settlement, based on basic salary.

Central government employees can save up to 300 days. Private companies usually allow 30 to 60 days, depending on the policy.

An employee must complete 240 working days in a year (excluding weekly offs and holidays) to qualify for annual earned leave under older rules.

It depends on the company’s internal leave policy. Some employers allow them to be clubbed, while others restrict mixing different leave types to maintain attendance rules.

Yes. Most companies allow carry forward within a limit. Extra days may expire or be encashed based on policy.

For private employees, it is taxable, except up to ₹3,00,000, which is tax-exempt once in a lifetime. For government employees, EL encashment is fully tax-free.

Usually no, unless the manager approves. Many companies extend the notice period if EL is taken.

Most employees earn 12 to 30 days of EL per year, depending on company or government rules.

Yes. Earned leave is paid leave, and employees receive full salary for approved EL days.

Yes. Every employer must offer paid earned leave as per labour laws (Factories Act, Shops & Establishments Acts, etc.).